Happy April! The first day of April often brings a bit of dread to many. And no, I am not talking about the fear of salt in the sugar bowl or toothpaste in your Oreos. But the first of April is often a reminder that tax day is quickly approaching. While this year we have a whole extra month (no April Fools’ joke here – taxes are due by May 17th in 2021) there is no harm in getting prepped and organized now.

Paper is the number one source of clutter that we see in homes. There is so much confusion and stress about what you need to keep and for how long that so many are paralyzed and just keep everything (yes I mean every single piece of paper) until they are overwhelmed. Tax time also brings a great deal of stress (no one likes talking about money), so it is easy to put it off all of the prep work but ultimately that just leads to more stress and angst.

I will leave the deduction, dependent, depreciation talk to the experts but today I am diving into 5 ways you can get organized for tax season. You should always consult your accountant on what is best for you and your taxes but these simple organization tips should help take some of that stress out of filing and maybe even make them enjoyable (no joke!).

5 Ways to Get Organized for Tax Season

Create one place for all of your current tax documents – You know your accountant is going to ask for them! From you W-2 to your 1098 for your mortgage interest, there are a number of documents that you will need for this year’s tax filings. Create a space in your home where you can pop each and every tax document that comes in so they are all ready to go when it is time to file. I love a small desktop file like this here that keeps everything close at hand but can then be rotated out for the next year’s documents once you have filed. For bonus points: go ahead and scan those documents into a file on your computer or in your Dropbox so they are ready to be uploaded to your accountant’s system.

Set up a system to track taxable donations – If you make a lot of charitable donations you know it can be beneficial to itemize them on your taxes but it can also be a lot of work! Set up a system to track your giving and make sure you have the proper documentation to be able to write them off on your taxes. I suggest a simple spreadsheet with the date of donation, amount, charity and a note if you have received the receipt. You will then want to organize the receipts either in your tax file, noted above, or scanned in to your digital file online. This one might be a little late for 2020 but your 2021 self will thank you next April.

Sort and scan your receipts – Any small business owners out there? If so, you have likely faced the mountain of receipts that tends to come at tax time and I won’t sugar coat it – receipts are one of the worst parts of owning a business. But they don’t have to be! I suggest getting in the habit of scanning a receipt as soon as it comes in and get them organized digitally. Investing in a receipt scanner like this one here can be helpful but did you also know you can scan on your phone? It is a game changer! Make sure that once you scan you are sorting by month and then renaming the file to include the vendor, expense category and date. You will still want to hold on to the physical receipt after you have scanned for three years but you can pop them in a folder and forget about them until it is time to toss. I suggest using pouches like these here for each month or year depending on how many receipts you have.

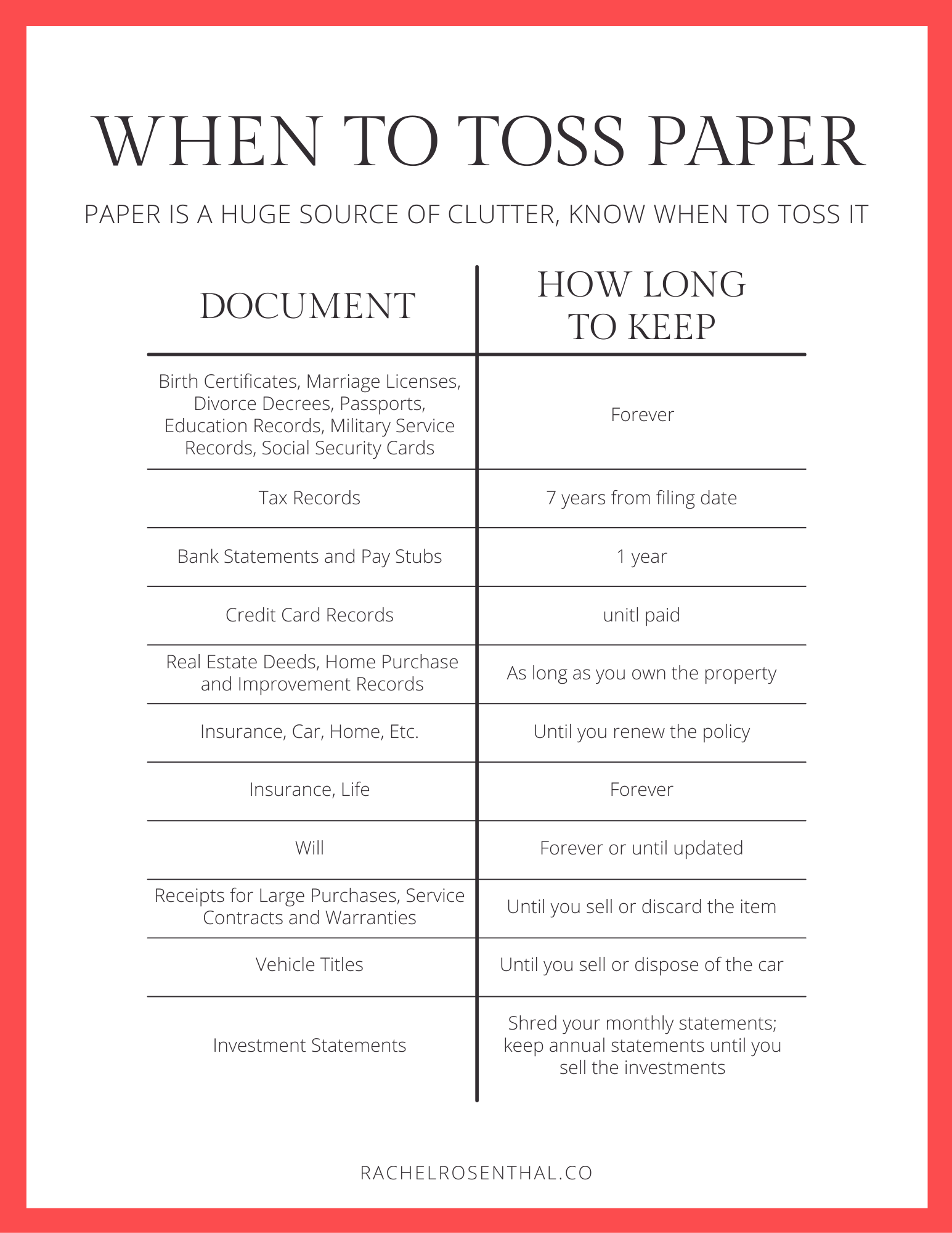

Know what to shred and when – This one is the biggie! You are likely holding on to more paper than you need to and it is just creating clutter in your home. I have included a guide of how long to keep different papers (downloadable version here) so you can finally give yourself permission to toss those paystubs from high school.

Set up a system for long term paper storage – As you will see on the guide there are a number of paper items that you do need to keep for a while (or forever) so you will need a paper organization system in place for long term paper storage. I suggest a small filing cabinet like this here or filing boxes like this here that can be safely tucked away until needed.

Favorite Products for Paper Organization

DISCLOSURE: This post may contain affiliate links, meaning when you click the links and make a purchase, we receive a commission.

+ show Comments

- Hide Comments

add a comment